I’m excited to be teaming up with Massachusetts Mutual Life Insurance Company for this sponsored post to help bring awareness to their educational tools and

resources and promote Financial Literacy Month!

We have a growing family and are setting new both long and short term goals, working on our budget and have even lined up an appointment to meet with a financial professional. I know we aren’t alone in wanting to have a better plan and learn more in how to increase our financial smarts!

To celebrate Financial Literacy Month this month, MassMutual is helping you take small steps to better understand your finances so you can secure your financial future and protect those who matter most to you.

They have incredible resources to help! – visit the new website, http://bit.ly/1IG6vjg, for tools and calculators, videos and articles. If you’ve been looking for some direction, check them out.

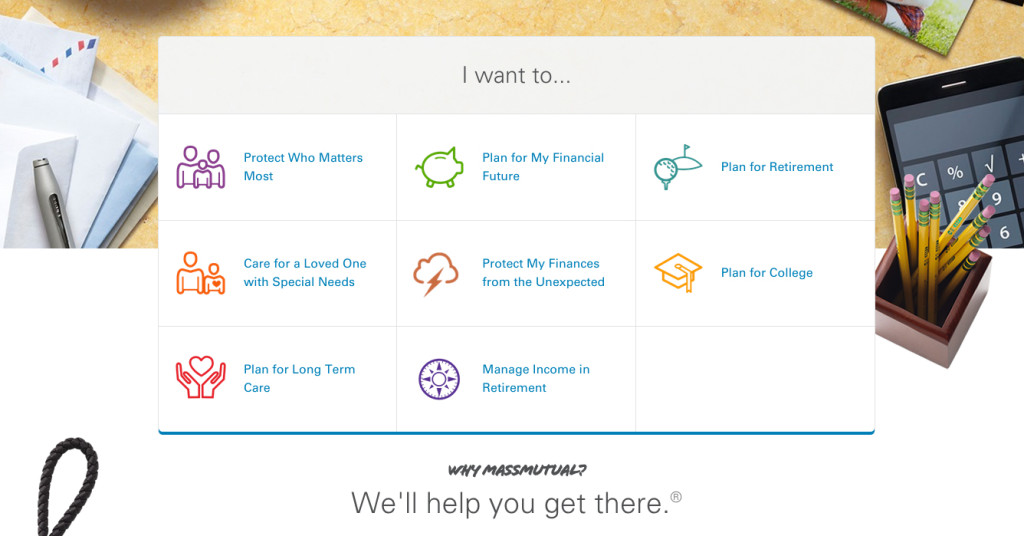

I love these 6 tips to Increase your Financial Literacy.

Sometimes it helps to see it laid out in front of you…so sharing the tips below!

- Identify your financial goals.

How can you start a savings plan if you don’t know what you’re tracking toward? The first step in understanding your finances is to identify your goals. Once you have an understanding of your goals, you’ll be able to take the next steps to achieving them. - Get organized.

Diving into your finances can feel overwhelming, especially if you don’t have a good sense of your current spending. Create a simple budget tracker to map out your income, expenses and any savings efforts you currently have in place. This will help identify risks and opportunities that you can address in the future, and can be the beginning of your financial strategy. - Use tools to help you project your savings needs.

Whether it’s calculating how much you need to save for your child’s college tuition or planning for your retirement, look for calculators online to help you. Many tools ask you to enter basic information to help you determine what you need to save and simple steps to starting a savings plan. - Consider your most valuable asset and how it affects your future.

Your home? Your business? Your ability to work? What is your most valuable asset? Have you considered your income and how it affects your well-being? Exploring disability insurance can go a long way to ensure your family is protected if you were too sick or injured to work. Watch this video to help get you started, or try out an income gap calculator to see how a disability might affect you and your family. - Teach your kids early.

Help your family be smart about finances, so they can build a strong future. Simple and fun activities can get them excited about saving for the future – like setting up a short-term savings plan with a personal piggy bank, and encouraging them to add to it when they have money to spare, from birthdays, allowances or loose change around the house. - Find the right people to help you.

When it comes to your finances, you need a strong team to assist you with important information and decisions. Working with a financial professional will help keep you on track and informed. It can take a minute to set up an introductory meeting, but the knowledge and guidance can go a long way to helping secure your financial future. Read more about the different types of financial professionals you can work with here and connect with one in your area here.

This is a sponsored post written by me on behalf of MassMutual.